April 1, 2022

The medium and heavy-duty vehicle (MHDV) market is dynamic, yet it often receives less specific attention than it requires. In the pursuit of decarbonizing transportation, there has been tremendous progress in the light duty sector, especially with regards to electrification. This success, however, has led some to suggest the solutions that have worked for passenger vehicles could easily be applied to the commercial vehicle sector – and this is not necessarily true. The MHDV market is much more complex and diverse and requires unique solutions designed for specific use-cases and duty cycles that do not exist in the light duty sector. This is why the Transportation Energy Institute has published our latest report focused on this sector and why we are forming a MHDV Committee – to give these vehicles the attention they deserve.

Why the focus on MHDV?

Much of the research the Transportation Energy Institute has published, as well as the majority published by other organizations, has focused on the light duty market. This is understandable given the size of the market and the total amount of greenhouse gas emissions attributed to the light duty market. But while MHDVs comprise only about 5% of all vehicles in operation, they contribute 30% of all on-road transportation greenhouse gas emissions. Therefore, there is an opportunity to have a significant impact on emissions by taking a more focused approach to this sector.

A Study to Define the Market

As a first step in addressing this market, last year the Transportation Energy Institute commissioned Guidehouse Insights to prepare our latest report, “The Easiest and Hardest Commercial Vehicles to Decarbonize.” A primary objective of the project, as advised by a series of focus groups we convened on the topic, was to detail the diversity and complexity of the MHDV sector by identifying the types of vehicles within each vehicle class (Classes 3 – 8), their duty cycle, the vocation to which they were deployed, and their total energy needs as well as their relative greenhouse gas emissions. By doing this analysis, it is possible to begin evaluating strategies that could most effectively reduce carbon emissions from the sector.

This market dissection revealed that MHDVs are very unique. They are designed to serve a more diverse set of customer needs and vary greatly in vehicle type, application and duty-cycle. These vehicles are produced in smaller quantities, which complicates the scalability of emissions reduction solutions, and they are prone to significant customization to satisfy specific vocations and use-case applications. The report takes a detailed look at the various elements of the market, breaking the MHDV market into 17 unique vehicle applications. These 17 vehicle applications combine to represent 91% of all MHDVs in the U.S. and account for 94% of the sector’s greenhouse gas emissions.

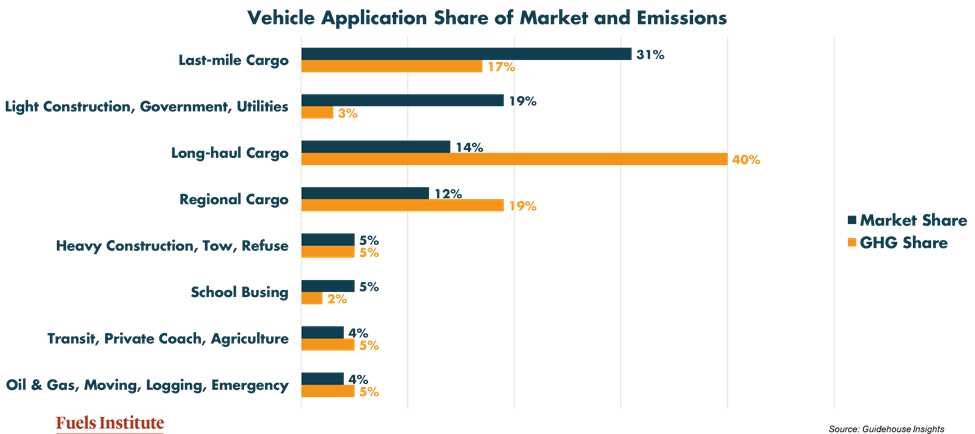

Market Share and Emissions Share Do Not Always Match

One of the key findings of the report is that market share does not necessarily translate into an equivalent share of emissions. Some vehicle applications, such as last-mile cargo and light construction, government and utility fleets, might combine for 50% of vehicles on the road, but contribute only 20% of total emissions. By contrast, long-haul and regional cargo represent only 26% of vehicles but 59% of emissions. What this demonstrates is that the most successful strategies for reducing greenhouse gas emissions will seek to address each vehicle application individually based upon the unique characteristics of each.

Decarbonization Opportunities and Challenges

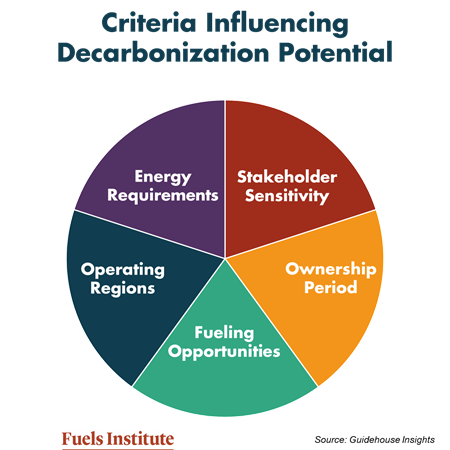

Once the various applications of the vehicles were determined and categorized, Guidehouse Insights took a look at which vehicle applications were more and less viable for implementing a decarbonization strategy. Each vehicle application was evaluated based upon five characteristics to determine if its features represented an advantage for decarbonization or an impediment. The five characteristics included:

- Stakeholder Sensitivity – How much pressure is there on the owners of such vehicles to reduce carbon emissions?

- Ownership Periods – Do owners keep their vehicles long enough to generate a return on their investment?

- Fueling Opportunities – Do the vehicles typically refuel at a central, return-to-base facility or do they rely on publicly available refueling stations? In other words, will they be able to control access to their energy or will they have to rely upon and wait for other parties to offer the energy they will need?

- Operating Regions – Do vehicles operate primarily in an urban setting where other priorities (i.e., air pollution, noise abatement, etc.) combine to enhance the value of decarbonization efforts or do they operate mostly in rural markets that may not include similar ancillary benefits?

- Energy Density Requirements – Do vehicles have auxiliary energy needs beyond transportation

From this evaluation, Guidehouse Insights identified the five applications that possess the greatest advantage for decarbonization and the five that possess the greatest disadvantage. The top five prospects represent 49% of all MHDV sales and 42% of the sector’s greenhouse gas emissions. These five may be considered to represent the lowest hanging fruit for strategic deployment of decarbonization solutions and include regional cargo, last mile cargo, school busing, refuse trucking and public transit.

From the analysis, school buses came across as possessing the greatest advantage for decarbonization based upon the five criteria considered – and this is not lost on other organizations who are working diligently to improve GHG emissions from these vehicles. However, while these vehicles may possess the characteristics most advantageous for decarbonization, they represent only 5% of the market and emit only 2% of the sector’s greenhouse gases. While this is a great opportunity that should not be ignored, the overall impact on the environment will be limited.

By contrast, the applications rated 4th and 5th in advantages for decarbonization, last-mile cargo and regional cargo, combine to represent 43% of the market and 36% of greenhouse gas emissions. As detailed in the report, decarbonizing these vehicles will be more challenging than school buses, but they still represent a great opportunity and their impact on the market would be significantly greater.

The five applications which represent the greatest impediments to decarbonization represent 20% of sales but 45% of greenhouse gas emissions and include long-haul, construction, oil and gas, tow trucking and logging.

One of the sectors that attracts significant attention is long-haul cargo, which while representing only 14% of the fleet accounts for 40% of the sector’s emissions. There clearly is good reason why these vehicles attract so much attention – reducing their greenhouse gas emissions would have a significant impact on the environment. Yet, they are also the most difficult of all 17 applications studied to decarbonize. Among the most significant challenges are the short ownership periods, the need for publicly available energy supplies and the significant energy needs associated with the vehicle’s duty cycles. None of these challenges are insurmountable, but it will require solutions that are tailored for this sector to encourage adoption.

Key Takeaways

Various stakeholders can take away key message from this study:

- Policymakers – Decarbonization strategies must be designed to address the unique needs of the vehicles in the sector and there will not be a one-size solution to satisfy all vehicle applications. To be successful, policies should:

- Align objectives and strategies with the unique needs of the vehicles in the market

- Accelerate the availability of lower carbon fuel options

- Approach the market holistically, considering vehicles and energy as an integrated system

- Vehicle owners – There is growing pressure to reduce emissions – from regulations to environment, social and governance (ESG) requirements to requirements imposed by suppliers and customers of the fleet operator. And with the latest Securities and Exchange Commission proposal to hold companies accountable for reporting emissions from their suppliers and customers, the pressure is set to increase even more. Understanding viable options for reducing emissions can help operators reduce emissions in the most cost-effective manner.

- Energy providers – There are customers in need of unique solutions and the pressure for them to take advantage of decarbonization opportunities is growing. Now is a great time to engage with your customers to find and implement those solutions.

MHDV Committee

This study represents the first specific foray for the Transportation Energy Institute to focus on the MHDV sector, but it will not be the last. To ensure future research is targeting specific needs within this market, and to ensure other broad-based research incorporates the special considerations of the market, the Transportation Energy Institute is forming a MHDV Committee. This new committee is open to all contributors and will serve as a market-specific advisory panel to the Board of Advisors. Any Transportation Energy Institute contributor who wishes to join this committee should contact Amanda Appelbaum, Director of Research, at aappelbaum@fuelsinstitute.org

If the transportation industry is going to get serious about reducing carbon emissions, we have to look specifically at where emissions originate and how to implement strategies that fit the specific use-cases of each vehicle in the market. There is great progress that can be made in the MHDV sector, and this latest report is the first step down the path to lower emissions and more efficient operations for the commercial vehicle sector.