April 6, 2020

There is nothing normal about what is happening throughout the world right now – a worldwide pandemic, oil price wars between two major global players, a stock market operating on the fundamentals of a yo-yo, and glares of condemnation towards anyone suffering with seasonal allergies. Whether you are a spring-breaker thinking this is all over-hyped nonsense, a traveling professional cancelling all of your reservations and exploring online meeting options, an investor riding daily waves of highs and lows or someone seriously concerned for the health and safety of your loved ones, one thing is absolutely certain – the way we live when this is all over will most certainly be different. How much our daily routines may change in the aftermath is yet to be determined, but I suspect we will approach travel and personal networking in a very different way than we have.

Of course, at a time like this I reflect on some of the great music from my youth and what is more appropriate than R.E.M.’s 1987 anthem “It’s the End of the World as We Know It (And I Feel Fine).” Well, I feel fine today but let me get back to you tomorrow—that’s how quickly the world as we know is changing. This was one of those songs that we all wanted to know the words to and stood in awe of those who actually could belt it all out without pause. I must admit, I never figured out all the lyrics because there was not internet back then…I could always get through the first few lines though:

That’s great it starts with an earthquake

Birds and snakes, and aeroplanes

And Lenny Bruce is not afraid

Oil Prices – What could happen at the pump?

Amid the COVID-19 pandemic, there’s been incredible turmoil in the oil markets. Following the dissolution in early March of the agreement between OPEC and Russia to curtail production in order to stabilize global oil prices and offset a shock to demand as China shut down in an effort to contain the virus, the benchmark price for oil went into a freefall as Saudi Arabia and Russia engaged in an aggressive price war. Within a week, the Brent crude spot price dropped nearly 40% and fell to the mid $20 per barrel range. The only time Brent traded in this range since 2006 was in early 2016 – even during the Great Recession Brent did not fall below $30 per barrel. We are in fact in rarely charted waters. In the past 742 weeks (January 1, 2006 – March 16, 2020), Brent has traded below $30 on a weekly average for only two weeks and below $40 per barrel for only 21 weeks.

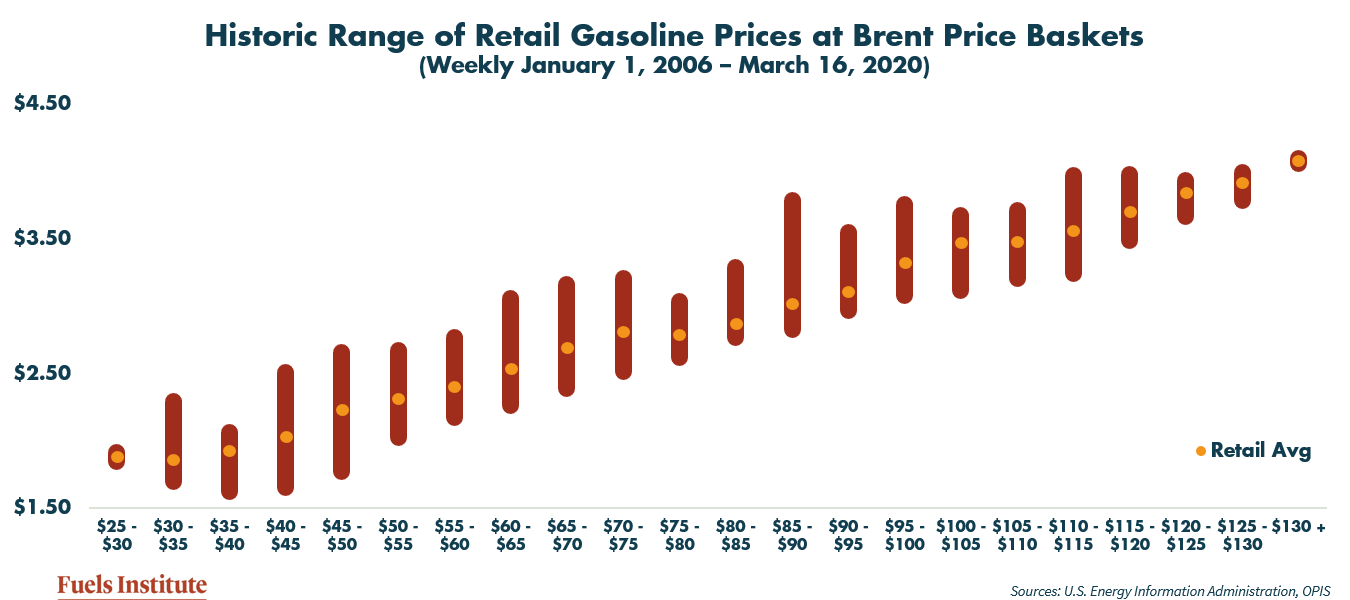

As we know, crude oil represents the biggest component of the retail price of gasoline, on average 60% but at times as much as 80%. If we look at history, we can see how retail gasoline prices have behaved when the price of oil moves. It is important to note that the pass-through of changes in the price of oil to prices at the pump can take time, sometimes a couple of weeks – retailers have more expensive fuel in their storage tanks and cannot pass on price drops until their wholesale prices drop and their inventory begins turns over. When prices are going up, retailers are also stuck in a difficult situation trying to earn enough money on their current inventory to purchase replacement gallons while battling competitors for price sensitive consumers. But in either situation at some point, pump prices have always followed oil.

Eye of a hurricane, listen to yourself churn

World serves its own needs

Don’t mis-serve your own needs

Speed it up a notch, speed, grunt, no, strength

The ladder starts to clatter

With a fear of height, down, height

Wire in a fire, represent the seven games

And a government for hire and a combat site

Left her, wasn’t coming in a hurry

With the Furies breathing down your neck

If we look back to early 2016 when Brent traded in the $20 per barrel range, the retail price of gasoline eventually dropped down to about $1.70 per gallon on a national average. By the week ending March 16, 2020, the weekly average retail price for gasoline was $2.288, which did not yet reflect the dramatic drop in crude prices. Of course, it is impossible to predict what will happen and we will have wait until the end of March and early April to see the full story of how this oil price collapse will affect retail fuel prices. But if we look at the historical relationship between Brent prices and retail prices, we might learn a little bit more about how the market reacts. The following chart plots the retail high, retail low and retail average price recorded by OPIS during the weeks in which Brent traded in certain price baskets.

Long Term Collateral Impacts

In the past I have engaged in debates about the share of vehicle miles traveled that are discretionary and the relative impact lower prices could have on overall fuel demand and travel behavior. My argument has been that the majority of miles traveled are not discretionary (i.e., work, school, errands, etc.) and are therefore not greatly subject to influence by the prices at the pump. The optional trips are certainly influenced by prices, but I believe that these miles are relatively small compared to the required trips. Consequently, I have disagreed with those who claim that lower prices will greatly influence total miles traveled. But now I think the overall situation is very different as we see non-discretionary travel take a major hit.

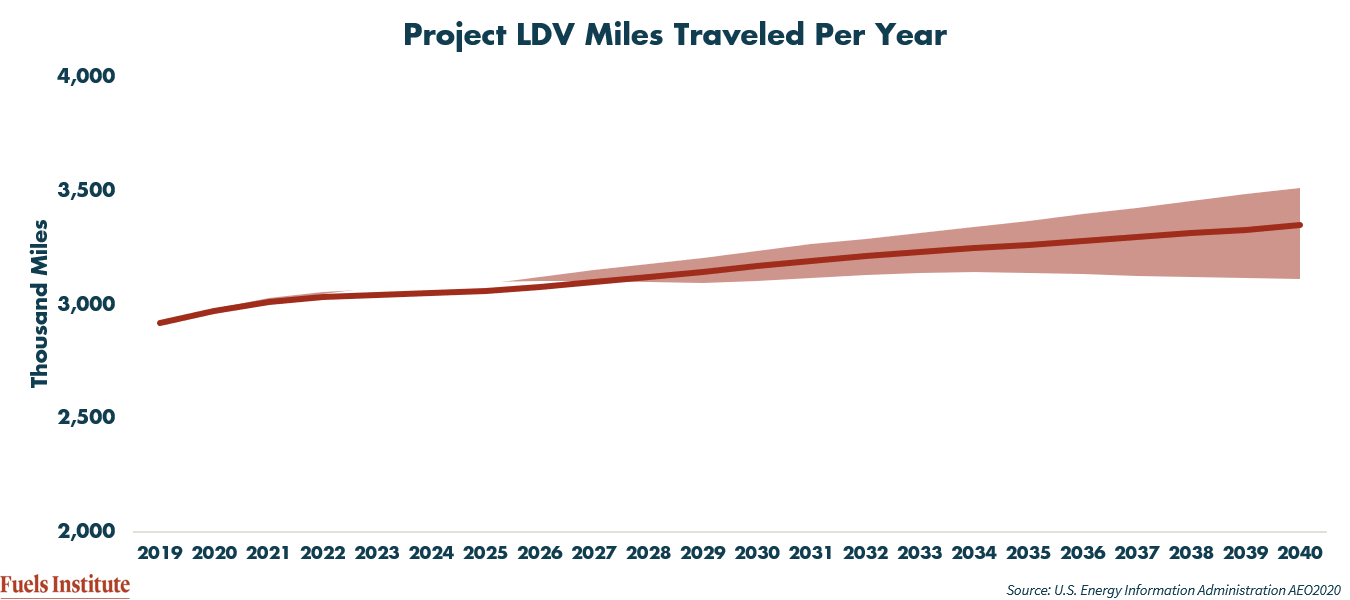

Prior to recent developments, the U.S. Energy Information Administration published its Annual Energy Outlook 2020 in which they projected that total miles traveled per year would increase 7% – 20% by 2040, depending on the price of oil. However, I suspect this outlook is already outdated.

Non-discretionary trips have largely been shut off as people are forced or opt to work from home and schools have transitioned to distance learning. Discretionary trips are likewise affected as restaurants have shifted to take-out only, recreational facilities have closed and most everyone is trying to avoid crowds. No reduction in retail fuel prices is likely to change the negative impact the pandemic is having on miles traveled or fuel demand – the immediate ramifications of this are clearly serious in terms of the economic impact.

Team by team, reporters baffled, trumped, tethered, cropped

Look at that low plane, fine, then

Uh oh, overflow, population, common group

But it’ll do, save yourself, serve yourself

World serves its own needs, listen to your heart bleed

Tell me with the Rapture and the reverent in the right, right

You vitriolic, patriotic, slam fight, bright light

Feeling pretty psyched

Yet beyond the immediate impact, I wonder if the lessons being learned might provide guidance for the future. With regards to transportation, the prevailing issue prior to the COVID pandemic and oil price war was the impact of emissions on the environment. This priority stands at the core of policies like the Corporate Average Fuel Economy standard, Zero Emissions Vehicles program, Low Carbon Fuels Standards, Transportation Climate Initiative, etc., and has really created the momentum for electrification of the fleet. With people staying home more often, what might be the collective impact on the environment?

I wonder…

- As employers begin to explore the necessary capabilities of telecommuting and begin playing around with online meeting programs and applications, will this open the door to greater use of remote working tools and reduce the need for millions of workers to commute to an office?

- As conferences transition to virtual events, will that begin to affect future networking events and affect business travel beyond surface transport and further affect oil markets?

- Will our experience with social distancing result in more efficient workplace policies, reducing stress, congestion and emissions?

- Would such changes result in a dramatic reduction in fuel demand or reduce the momentum for transitioning to electrification?

- How might such a change in non-discretionary miles traveled affect the overall transportation economy?

We are too early in our experience with social distancing and virtual experiences to really understand their overall potential, but it is not too early to begin thinking about the long-term implications of a potentially dramatic shift in how we interact with one another. Transportation is essential to facilitate face-to-face interaction, but if we replace the handshake with video conferencing from the comfort of our homes, will we really want to return to the ways of old (you know, two weeks ago)? And if we only modify modestly, say we start telecommuting one day out of five, that could reduce miles traveled by 20%, impact fuel demand and dramatically reduce emissions. It’s something to think about – if this happened, how would it affect your business.

I am not an alarmist nor do I panic about anything, but when you really think about how we might emerge from the current curtailment in activities, it could really be the End of the World as We Know It (and I Feel Fine)!

It’s the end of the world as we know it (time I had some time alone)

It’s the end of the world as we know it (time I had some time alone)

It’s the end of the world as we know it and I feel fine (time I had some time alone)