John Eichberger |

September 2025

For years, the prognosticators were projecting that battery electric vehicles (BEVs) would dominate the market in a matter of years. In 2022, Bloomberg New Energy Finance predicted that 50% of vehicles sold in the United States by 2030 would be electric. This forecast was supported by others – McKenzie and Company in 2021 predicted 53% of vehicles sold in 2030 would be electric, as did Boston Consulting Group the following year. The Biden Administration enacted rules that would have essentially required two-thirds of vehicles sold in 2032 to be BEVs. The BEV drumbeat was constant and relentless. Today, however, the news coverage is painting a very different picture – U.S. policies have changed and vehicle manufacturers throughout the world are revising their strategies, delaying or canceling BEV plans and reinvesting in internal combustion engine (ICEs). Was the BEV hype just that – hype and no substance? At this point we must repeat what we said before – don’t believe everything you read and hear.

Projections Did Not Match Data

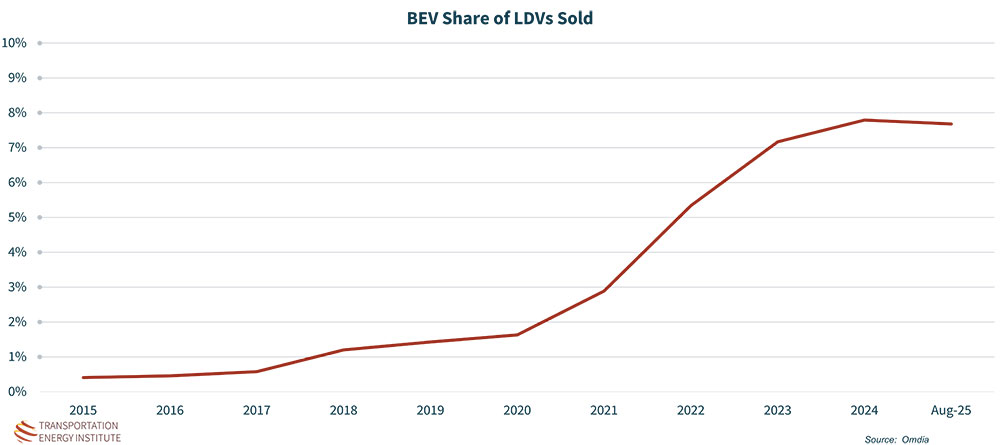

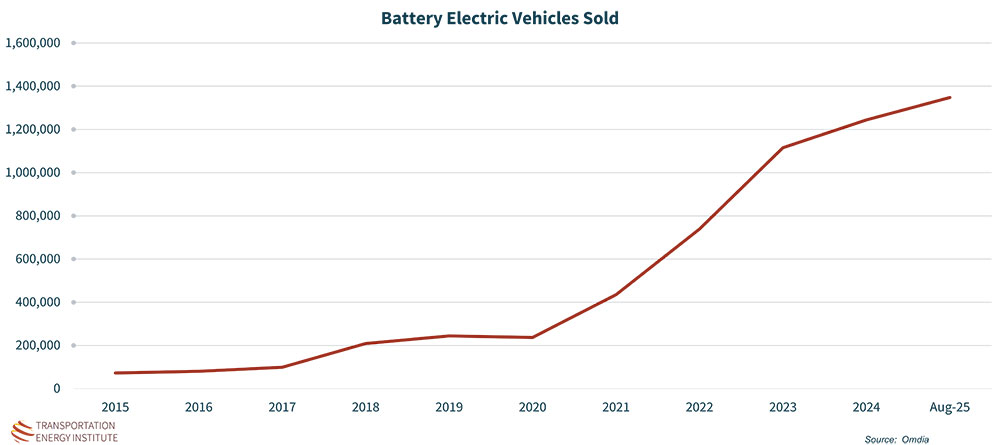

When all of those projections were released, I was quick to question their validity and durability. I understood the basis for their analysis – the announcements from manufacturers to quickly transition to BEVs and the building pressure from global governments painted a very optimistic future for the technology. But TEI tries to focus on what is happening in the market and we did not see the hockey stick adoption curves developing as clearly or as early as others did; the future was always cloudy in our crystal ball. The data did not show BEV market share of light duty vehicles sales accelerating at a rate that would match the forecasts, and in fact market share seemed to plateau below 8% in 2023.

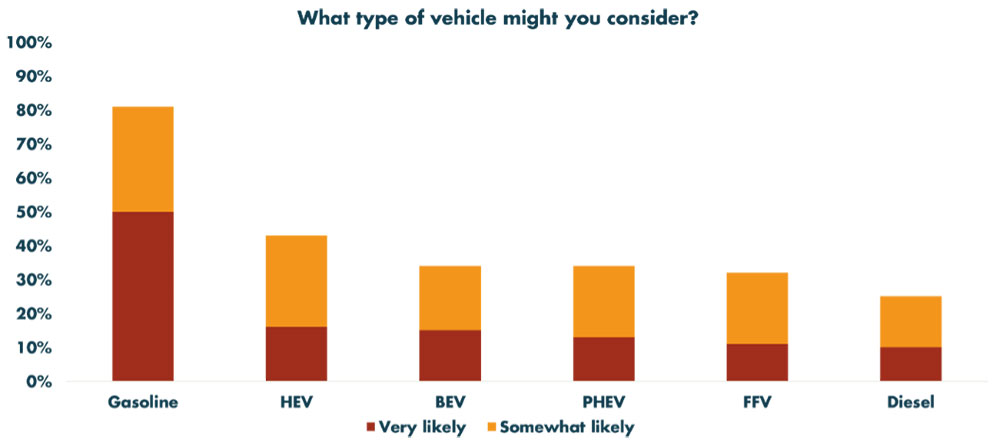

In addition, consumer uncertainty remained. In 2023, we published the results of a consumer survey that found that, while half of consumers had relatively positive attitudes towards BEVs, of those who were at least somewhat likely to acquire a new vehicle within the next two years only 34% were very or somewhat likely to consider a BEV.

Recent Developments

Most recently, the election of Donald Trump in 2024 started a regulatory push to remove most of the incentives and requirements put into effect by the Biden Administration to support a transition to electrified powertrains. In addition, Congress passed legislation revoking California’s authority to implement its ban on ICE vehicle sales in 2035 and Prime Minister Mark Carney delayed implementation of Canada’s electric vehicle program pending further review. To casual observers it might seem like the train was running off the tracks, but it is important to remember that vehicle technology and consumer adoption is not contingent on politics alone.

That said, prior to these political developments, there were cracks starting to show in the market that seemed to undermine previous forecasts and predictions. Major automakers were reporting significant losses with their BEV lineups, sales were falling below lofty expectations, automobile dealers pleaded for more hybrid vehicles rather than pure BEVs and industry leaders were lamenting that consumers were not quite ready for the rapid transition. Again – does this mean there is no future for BEVs?

Future Remains Bright

I would argue there remains a bright future for BEVs and other electrified powertrains. I tend to focus on the market share of different vehicle types (as evidenced by the chart above) because it reflects the pace of change within the context of the entire market. But it is worth reminding everyone that since 2015, American consumers have purchased 5.8 million BEVs and sales have increased every year, except during COVID in 2020. Despite the headlines highlighting the chinks in the BEV market, sales through August 2025 had already surpassed total BEVs sold in 2024. While most suspect sales contracts will spike in September and then drop during the fourth quarter with the loss of the federal purchase incentive, the fact is millions of American like BEVs – and that is not likely to change because of shifts in policy.

When I read articles about manufacturers changing their plans for introduction or production of BEVs, I am not surprised because I believed when those plans were announced they were quite aspirational. I don’t interpret these recent announcements as the industry abandoning a technology many of its leaders have extolled as the future. Rather, I see an industry recalibrating its strategies to meet consumer interests, to refocus on delivering vehicles consumers want to buy rather than forcing vehicles into the market to meet expectations from global leaders or politicians. And this is a recipe for success.

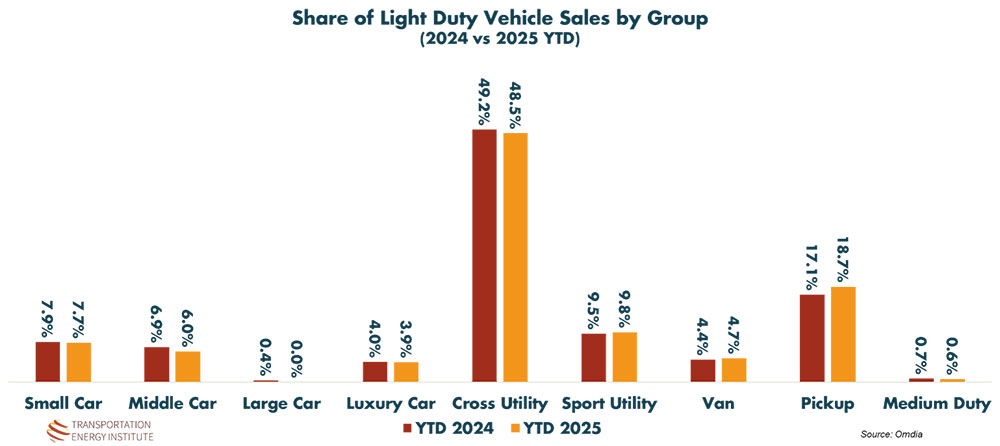

In my opinion, consumers have spoken loud and clear. The majority want cross-over utility vehicles (CUVs). These vehicles consistently account for nearly half of all vehicles sold in the U.S. And when we dissect this important class of vehicles, what we find is a very bright spot for BEVs. Through June 2025, Americans purchased 1,891,000 CUVs. The number one selling CUV was the Model Y by Tesla, and that was after recording a 31% drop in sales verse same period in 2024. When manufacturers deliver vehicles that consumers want to buy with electric powertrains, many consumers will buy them; not all consumers, but a lot of them.

And in case you think I am alone in this sentiment, an article September 24, 2025 in Automotive News expressed similar sentiment, with the headline including “The credits’ end reflects growing political skepticism of EVs, but experts said sales are not expected to fall off a cliff.” In the article, an expert from Carnegie Mellon University said:

“Upfront price, longer range, faster ability to recharge … those things continue to get better,” said Jeremy Michalek, director of the vehicle electrification group at Carnegie Mellon University. “There’s still a reason why we might expect a future with higher electric vehicle adoption, even if it’s not happening as fast as we might have initially thought.”

Infrastructure Remains a Key Ingredient

Despite what I consider to be a bright future, there are hurdles that still must be overcome if BEVs are to achieve a meaningful share of the vehicle fleet in the United States. Chief among these is to convince potential BEV drivers that they will have access to affordable, reliable and fast recharging when they are away from home. Yes, a significant share of recharging events will occur while the vehicles are parked at home, but without the assurance that in-market charging will serve their needs a significant portion of the potential BEV buyers will remain uncertain.

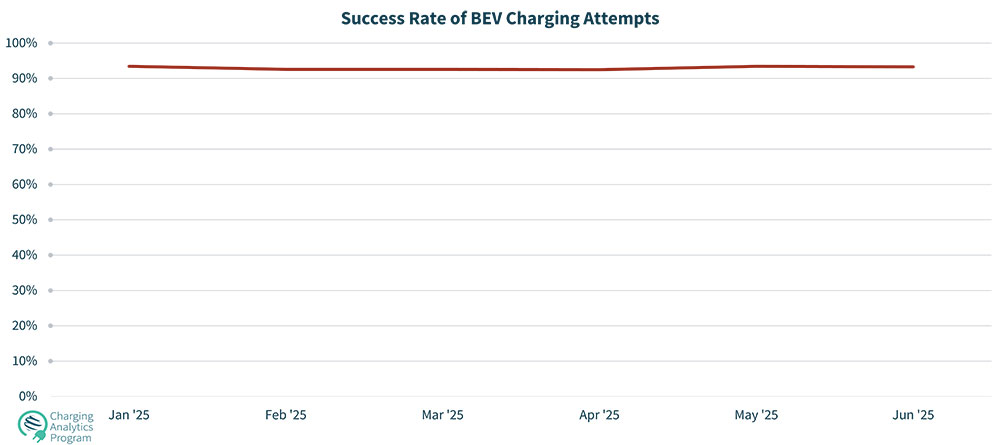

According to the Alternative Fuel Data Center (AFDC), in September 2025 there were 13,625 stations offering charging through 62,078 DCFC ports. TEI’s Charging Analytics Program (CAP) reports that reliability of these chargers also has improved and through the first six months of 2025, 93% of charging attempts were successful – quite an improvement over previous reports.

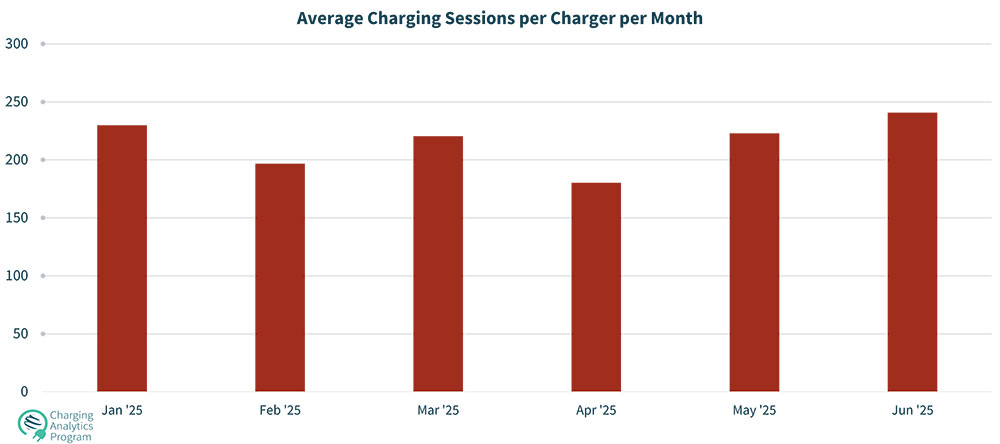

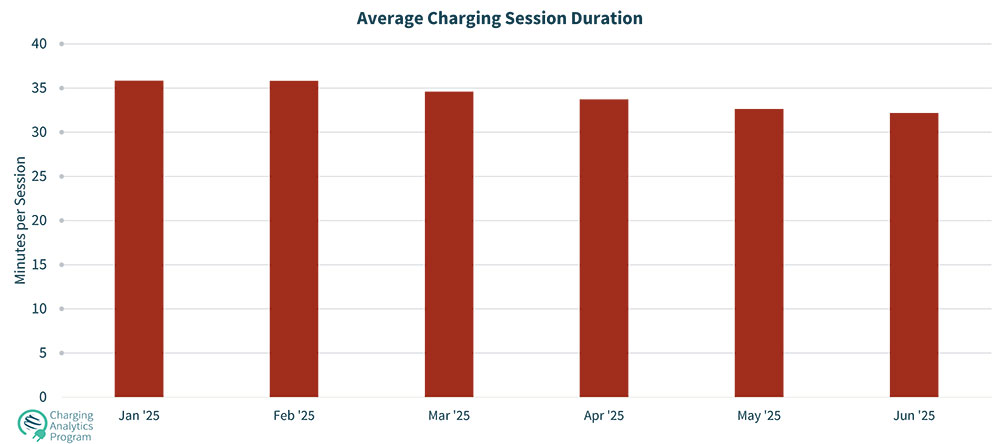

From a business perspective, despite the apparent headwinds in BEV adoption, there remains a viable business case to support investment in infrastructure. CAP has analyzed utilization data from more than 30,000 DCFC ports and found that, on average, these ports attract 215 customers per month and those customers spend approximately 34 minutes per charging session. For a business with four charging ports on their property, that equates to about 430 hours of dwell time that could be converted into sales.

Public charging was also given a shot in the arm with the restart of the NEVI program which no longer demands chargers every 50 miles along primary corridors. Rather, the new rules allow for more flexibility for states to manage the $5 billion program. This will likely create greater access to the NEVI funding for retailers which already have established brick-and-mortar locations and offer the services drivers are looking for. In addition, chargers are becoming more universal in terms of the vehicles they can service, which creates a larger market opportunity for charger operators. For example, Telsa drivers can now locate non-Tesla branded chargers equipped with J3400 connectors and most vehicle manufacturers are enabling their vehicles to charge with J3400 connectors. This means most chargers in the market will soon be capable of charging most vehicles on the road.

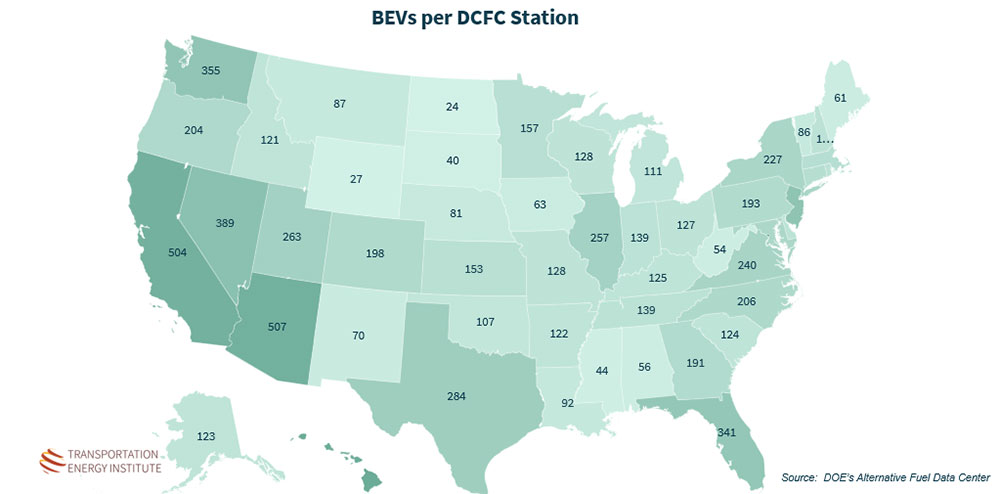

While there is growing demand and an improving business opportunity for installing chargers, it is also important to know where they are in demand. The following map shows the number of BEVs in operation for every DCFC station. The higher the number on the map, the greater the opportunity for new DCFCs to serve BEV drivers in that state. Caution – This is only a starting point to begin to evaluate opportunities, a much more detailed analysis is required to determine the actual opportunity in a given market.

Conclusion

As we have said repeatedly for the past 12.5 years in which we have existed, you must not assume everything you read represents the whole story. There are so many variables and uncertainties that affect market development, it is critical that you consider a wide variety of sources and perspectives. That is what TEI is designed to do – to provide a more objective, broad perspective of market fundamentals to support your own analysis of where the market is heading and what opportunities or challenges may lie in the road ahead. We are also keeping a close eye on the application of artificial intelligence in vehicles and how that might ultimately (or soon) affect driver behavior as it relates to charging, refueling and general shopping. Stay tuned for more on that rapidly developing topic.