The Transportation Energy Institute’s Electric Vehicle Council has released a timely new whitepaper in November 2025, that comprehensively examines the funding landscape available for electric vehicle (EV) charger installation across the United States. This paper, EV Charging Infrastructure Funding is notably significant given the evolving market dynamics and challenges faced by stakeholders in the EV infrastructure sector as of late 2025.

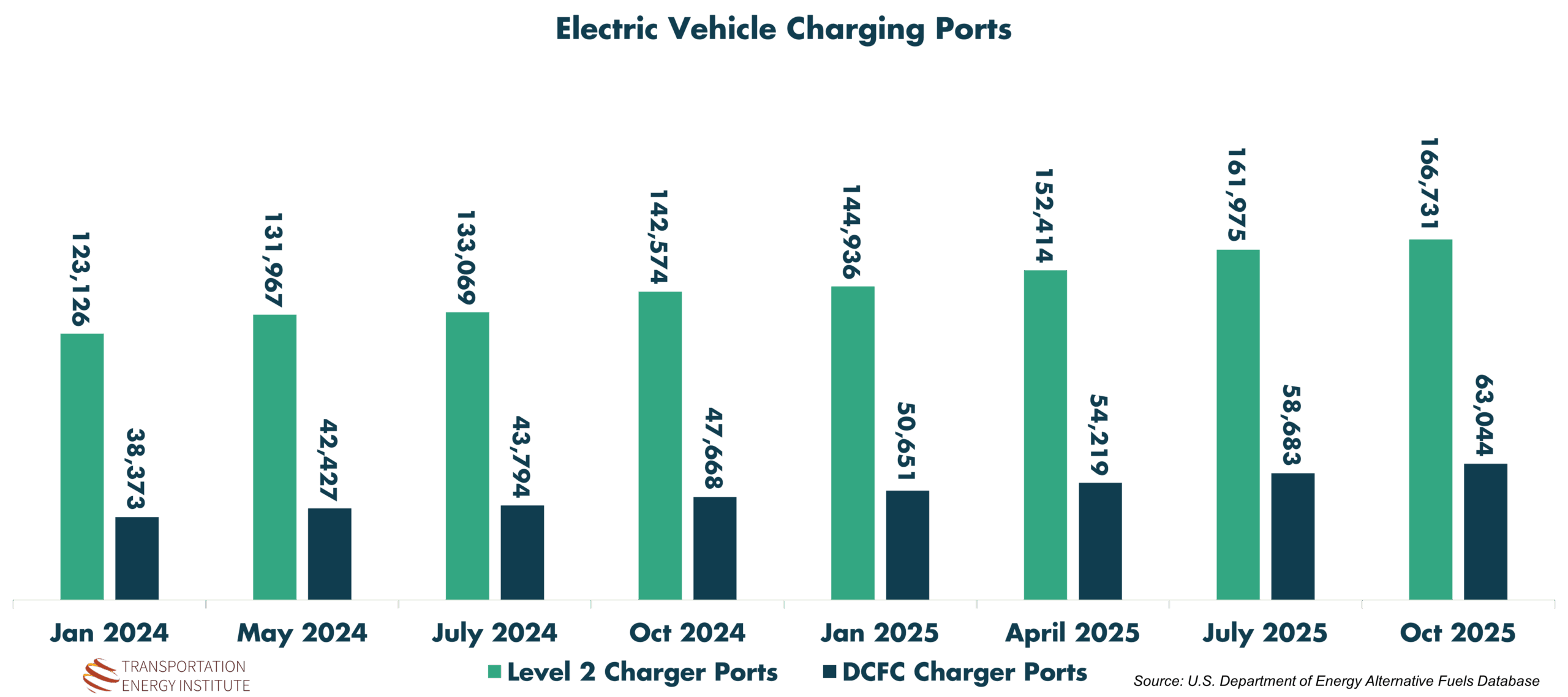

Public charging infrastructure is growing but its visibility is lacking, and consumer sentiment suggests that we need faster growth in more strategic areas in the U.S. Revised federal funding guidance may help strategic development over the following 12 months. Since January 2024, the number of direct current fast charger (DCFC) ports in the U.S. has increased 66% and the number of DCFC stations has increased 54%. Despite headlines that may infer the contrary, EVs will continue to increase their sales and their share of vehicles in operation, adding to consumer demand to support additional charger installations.

Overview of the Funding Landscape

The paper looks beyond just the federal National Electric Vehicle Infrastructure (NEVI) program, which designates $5 billion for EV charger deployment, and includes expansive analysis of state and utility programs. It identifies how businesses interested in installing EV chargers can navigate these multiple funding sources, including federal and state incentives, utility rebate programs, and low-interest financing options. This breadth makes the paper a crucial resource for site hosts, investors, and policymakers seeking to understand where and how funding can be accessed effectively in diverse regional markets.[1][2]

Lessons from Program Implementation

One of the key insights from the EV Council’s work is that the true challenge is improving the economics of EV charging installations so that businesses can see a viable return on investment (ROI). While much focus has been on lowering capital expenditures (CapEx) for installations, operational expenses (OpEx) such as system uptime and maintenance also critically impact profitability. Moreover, the Council highlights that while federal funding like NEVI is pivotal, it often comes with regulatory strings and reporting requirements that may deter some participants. The paper suggests streamlining these programs to eliminate red tape and align incentives better with market realities.[1]

Market Realities and Strategic Insights

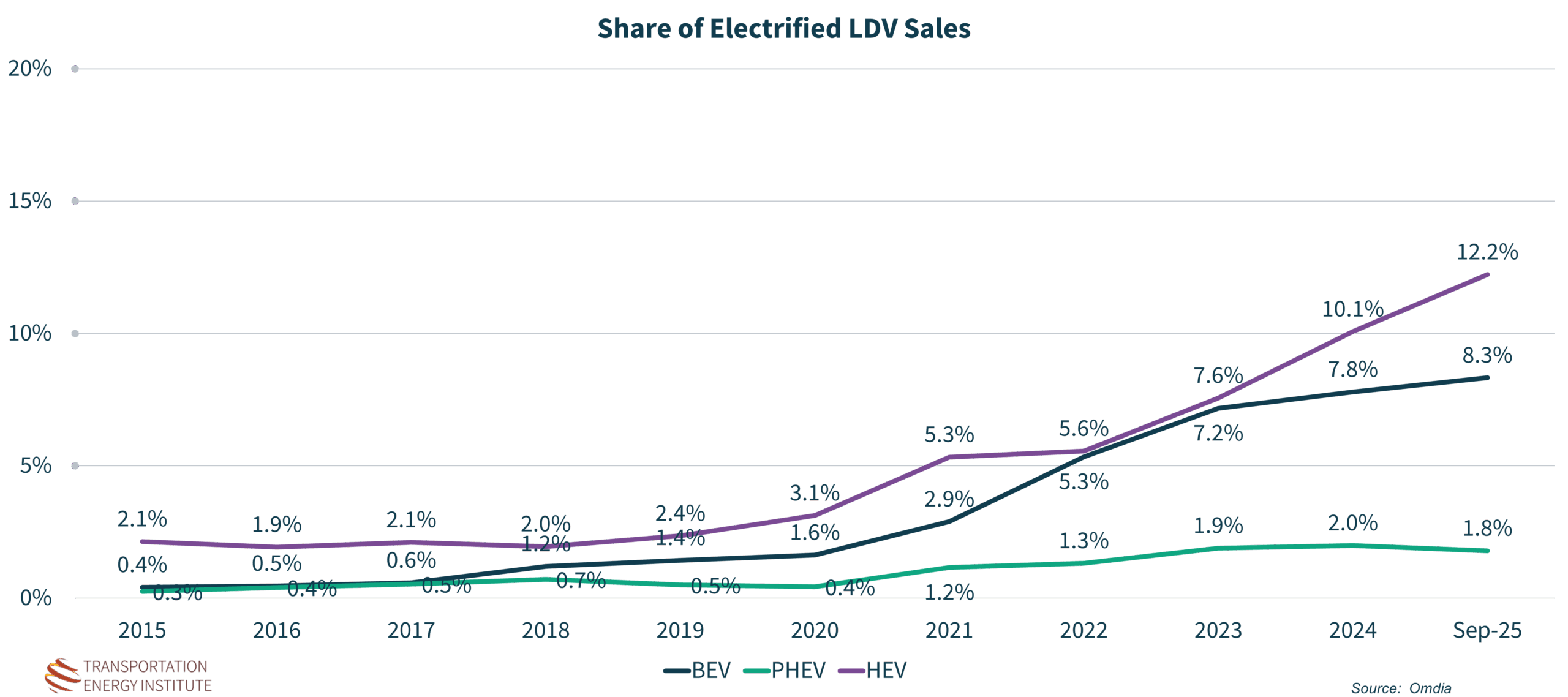

Despite the federal EV tax credit ending in September 2025, EV sales in the U.S. have grown substantially, surpassing previous years, indicating sustained market expansion albeit at a moderated pace. The loss of the federal tax incentive for EV purchases will have an impact, but most analysts expect the market to continue to expand.

The paper stresses that the need for reliable charging infrastructure remains urgent and growing. It outlines how funding programs can reduce upfront financial risks for businesses looking to enter the market, but success requires detailed market analysis and a keen understanding of customer behavior to convert EV drivers into loyal patrons of the charging sites and associated retail offerings.

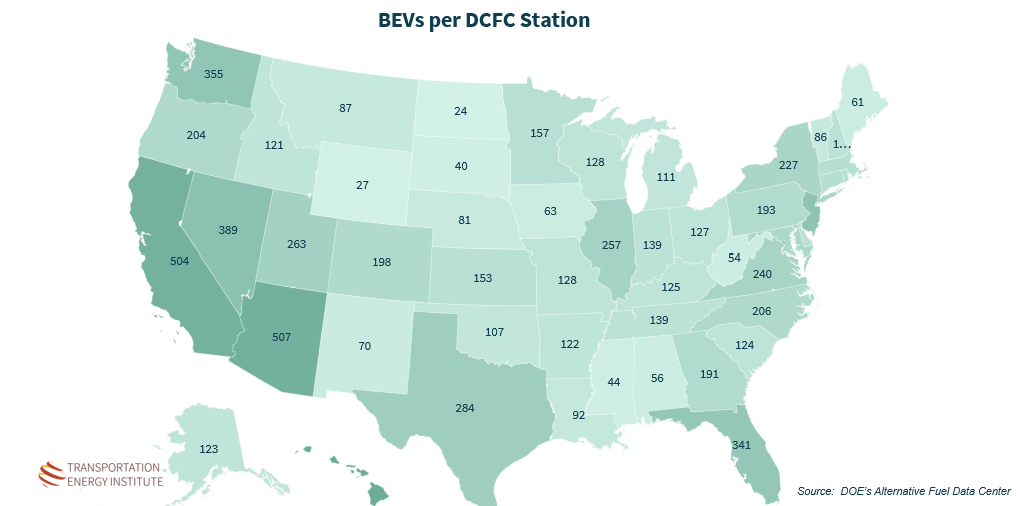

The Council reports an evolution in strategy—from a rapid build-out of charging sites to a more data-driven, regional approach focused on utilization rates and site expansion. Some areas experience overutilization with charging queues, while others show underuse, calling for careful site selection and scalable installation designs in future deployments.[1]

Historically, federal funding necessarily focused on primary corridors throughout the U.S. As the EV market slowly matures, however, we begin seeing areas where demand, based upon registered EV counts, is significantly higher. Looking at additional utilization data, we can also determine increasing demand in local urban areas. This is supported by current trends in private investments to expand the number of public DCFC at existing sites where utilization is high and foregoing additional investments where utilization rate is low, thereby improving overall ROI. In this map showing the ratio of EVs to DCFC stations, the states with the higher numbers indicate general markets that are in need to additional installations to ensure EV drivers have access to available chargers when they need them. This state-level view is just an initial look; specific market identification would require more granular analysis.

Utility and Operational Considerations

The paper also emphasizes the critical role utilities play in the EV infrastructure ecosystem. Stakeholders are strongly advised to engage with local utilities early to understand available incentives, interconnection timelines, and operational support. The Council discusses alternative charging solutions, such as battery-backed systems, that can reduce reliance on grid connections, helping to manage costs and speed deployment. Utility readiness and partnerships can “make or break” projects, as some utilities are proactive in supporting EV charging, while others may lag behind.[1]

Conclusion: A Resource for Stakeholders

In conclusion, this whitepaper serves two primary functions. First, it guides businesses on how and where to find funding for EV charger installations. Second, it provides policymakers and program designers with insights on what has worked and what needs improvement in existing funding mechanisms to foster market growth and operational efficiency. The EV Council encourages stakeholders to use this comprehensive resource alongside their charging analytics data to make informed decisions that reduce investment risk and align with long-term electric mobility trends.[1]

Those interested can download the full paper for free from the Transportation Energy Institute website and are encouraged to engage with their utilities and multiple charge point service providers to explore tailored solutions that best fit their business strategies.

This outlook reflects the nuanced state of EV charging funding and market development as of November 2025, supporting an industry poised for steady growth despite shifting policy and economic landscapes. The need for smart capital deployment and strategic operational planning remains paramount in building the EV infrastructure of the future.[1]

- https://fuelsmarketnews.com/whitepaper-critical-funding-strategies-for-public-ev-charging-infrastructure/

- https://afdc.energy.gov/fuels/electricity-infrastructure-state-planning

- https://www.transportationenergy.org

- https://lynkwell.com/resources/ev-charging-funding-outlook-whats-next-for-the-industry-in-2025/

- https://www.eei.org/-/media/Project/EEI/Documents/Issues-and-Policy/Electric-Transportation/EV-Forecast-Infrastructure-Report.pdf

- https://www.transportation.gov/rural/ev/toolkit/ev-infrastructure-funding-and-financing/federal-funding-programs

- https://environment.transportation.org/news/fhwa-issues-635m-in-electric-vehicle-charger-grants/

- https://www.transportationenergy.org/councils/electric-vehicle-council

- https://driveelectric.gov/states

- https://www.thewellnews.com/in-the-states/states-begin-allocating-ev-charger-project-funds-after-battle-with-trump/