March 07, 2018

“The fundamentals of the market demonstrate that meaningful change will take time,” Eichberger testified. “Changing today’s transportation system will not be like introducing a car engine to replace the horse and buggy, or the introduction of the smartphone to ultimately replace a wallet and personal computer. The major difference is this: Each example of a major, successful disruptive event delivered compelling, immediate and tangible value to consumers that improved their quality of life in some real way. What transportation paradigm shift could do that?”

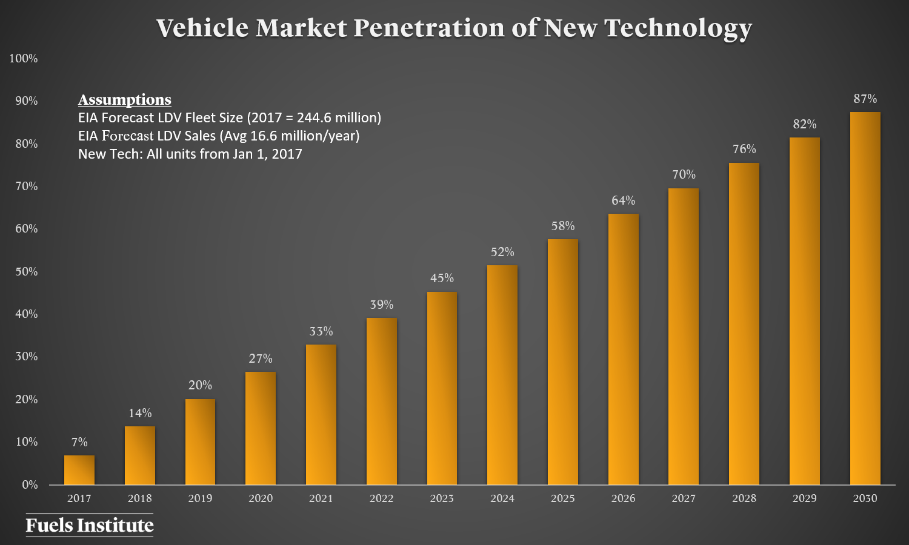

In his testimony, Eichberger explained that because of the significant size of the light duty vehicle market, even if very new vehicle sold were equipped with a new technology it would take years to gain significant share of vehicles on the road. To amplify this point, he presented the following chart that demonstrated, in such a scenario, it would take about seven years before the new feature is present in more than 50% of the vehicles on the road.

“This is not to dismiss advancements in vehicle technology or powertrain diversification; it is simply a recognition of the size and scope of the current market, the amount of time vehicles remain in service and the nature of human behavior,” he continued.

Eichberger noted that battery electric vehicles (BEV) and plug in hybrid electric vehicles (PHEV) are increasing their presence in the market, with sales growing 26% from 2016 to 2017. However, even if such growth rates were sustained, the impact on the overall fleet by 2035 would be relatively limited. Assuming an aggressive forecast of 26% annual sales growth through 2025, and then 20% annually through 2035, Eichberger said that BEV and PHEVs could represent 42.9% of all light duty vehicles sold but would account for only 10.4% of vehicles on the road.

Eichberger discussed several external variables that could affect this projected growth trajectory. High oil prices (above $80 per barrel), fleet adoption of BEVs and/or PHEVs, increased demand for mobility services, and global regulations banning internal combustion engines (ICEs) could all advance the rate of market change. At the same time, sustained low oil prices (below $80 per barrel) and advancements in the efficiency of internal combustion engine design, potentially paired with a change in fuel specification, could likely slow the rate of market change.

“When evaluating the future of the transportation market, the headlines and forecasts that predict a rapid change in market structure and behavior can be overwhelming,” Eichberger acknowledged. “It is important to take this type of information and view it within the context of the existing market to better understand the validity of the predictions.”

“If I could leave you with one message today it would be this: The market will change, but absent significant influence from an external factor, such as government policy, it likely will take decades before major shifts in vehicle composition and the fuels that power them will be achieved.”

The Transportation Energy Institute is a non-profit, unbiased organization that does not advocate. Eichberger’s testimony reflected his perception of the vehicles and fuels market and did represent the position of any individual or organization affiliated with the Transportation Energy Institute. His testimony should in no way suggest or infer that the Transportation Energy Institute supports or opposes any legislative or regulatory initiative.

View the complete testimony here. (PDF).